Major Feature Releases

Tutorials

CUB Kingdoms

Cross-Platform, Autocompounding Yield Vaults

This feature is modeled after one of the most popular DeFi use cases: auto-compounding vaults. Vaults like these allow LPs to stake their liquidity, earn an underlying asset (i.e. CUB) and automatically compound their LP position via smart contract.

The smart contract sells the LP rewards from external platforms (i.e. CAKE if the Kingdom utilizes Pancakeswap) as they are earned and auto-reinvests in the base assets while still giving the user an allocation of CUB harvestable rewards each day.

Status of the Kingdoms Migration (4/7 Vaults Migrated):

- Kingdoms Phase 1 (BNB-BUSD, CAKE)

- Kingdoms Phase 2 (ETH-BNB, DOT-BNB)

- Kingdoms Phase 3 (CUB Staking + BTCB-BNB)

- Kingdoms Phase 4 (Final Migration - BTC, ETH, USD Stablecoin) - In Progress

- CUB Staking Dividends With Kingdom Management Fees - In Progress

What's a Kingdom?

Cub Kingdoms are cross-platform, autocompounding yield vaults. This is a fancy way of saying that Kingdoms are built on top of smart contract vaults that allow you to:

- 1.Deposit cryptocurrencies

- 2.Earn yield from external host farms (i.e. Pancakeswap, Bakeryswap or Belt)

- 3.Sell that yield (CAKE, BAKE or BELT) back into the base asset pair and re-pool it (autocompound your deposit currency)

- 4.Earn yield in CUB

In essence, Kingdoms allow you to farm 2 platforms simultaneously: the Host Farm (PCS, Bakeryswap, Belt, etc.) + CUB Reward Multipliers on top of it.

This leads to higher APYs for our users (since you're earning from two different currencies simultaneously) and most importantly it leads to a FAR more sustainable tokenomic model for CUB.

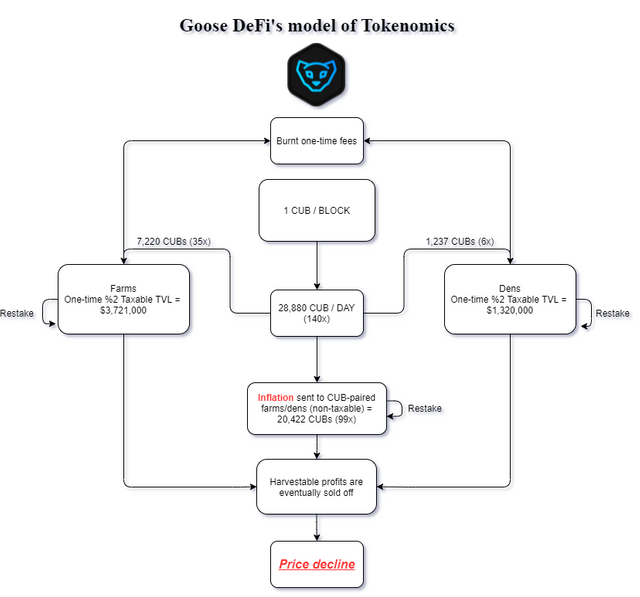

The following are some infographics showing the change in CUB's tokenomic model. The Kingdoms Vault Migration is our shift from the GooseDeFi platform model (unsustainable) to the Autofarm platform model (sustainable).

image.png

image.png

Kingdoms vaults pay far less CUB than standard farms/dens but maintain high APYs. This is achieved through smart contract technology that takes deposited funds to external host farms and pools those funds there to yield farm the host cryptocurrency.

For example, the ETH-BNB farm utilizes the Pancakeswap platform. This means that ETH-BNB deposits earn CAKE rewards + a small CUB harvest (1.5x multiplier vs. the 6x multiplier on the old Cub Farm vault. Additionally, your CAKE rewards will be sold autonomously back into ETH-BNB and added to your staked vault position on Kingdoms, leading to higher APYs since the autocompounding is far more efficient than manual transfers.

Why is This Bullish For CUB?

If you rewind the tape a few months, we all realized the unsustainable model that CUB was built on. GooseDeFi led the charge in this revolution of new platforms popping up on the Binance Smart Chain that allowed users to yield farm at ridiculous APRs.

EGG went into a state of steady decline and platforms that copied that tokenomic model (like CUB) went along with it in the months that followed.

This is when we decided to research more advanced smart contract technology. Rather than simple yield vaults that paid only CUB harvests, we decided to adopt the approach taken by far more successful platforms like Autofarm.

Today (July 8th), we're 4/7 in the Kingdoms vault migration. If you look at the CUB price, we've actually reached an interesting state of equilibrium between buyers and sellers. CUB is no longer declining in price as it was prior to the launch of our first 4 Kingdoms.

We've designed the entire Kingdoms release in such a way that we believe a turning point is being reached for the CUB platform.

The overall inflation that is directed toward Kingdoms is nearly 4 times less than the inflation directed toward our old Farms/Dens model.

We're currently seeing the impact of deprecating the DOT and ETH-BNB farms. Once these were migrated to Kingdoms, we saw a massive drop in the selling of CUB.

Much of the selling pressure on CUB in the past few months was from capital that entered the Farms/Dens (i.e. BTCB-BNB, ETH-BNB, BTCB, ETH, DOT, etc.), paid a one-time 2% deposit fee and farmed an extremely large amount of daily CUB rewards essentially for free. This is the Goose model and it clearly has sustainability issues.

With Kingdoms, we're turning the concept of yield farming with CUB completely on its head. Now, yield farms on Kingdoms earn a very low CUB Multiplier but they maintain a high APY by stacking yield with platforms like Pancakeswap, Bakeryswap, Belt and others in the future.

Additionally, Kingdoms don't take a one-time deposit fee. Instead, they take an ongoing management fee on the CAKE, BAKE and BELT yield farming rewards. Kingdoms take a 7% management fee on these rewards and autonomously buyback and burn CUB. A separate 3% management fee is taken and distributed back to CUB Kingdom stakers as liquid BNB Rewards (this feature will be turned on shortly after the full migration of Kingdoms).

There's a very specific reason why we spent so many weeks/months designing, developing and implementing Kingdoms. We believe it marks a major turning point for both the CUB price and the long-term viability of the platform as we continue to spend the months and years ahead developing and adopting more complex smart contracts to allow for various DeFi operations like yield farming, synthetic assets, collateralized loans and more.

Last modified 10mo ago